Investing in high demand high quality hardwood is an unparalleled way to grow your money, for four basic reasons:

1. Revenue - The worldwide increasing demand for wood will result in further price increases. Because of the long growth cycles, the supply of hardwood cannot be expanded rapidly. Over last decade, the value of private tree plantations has almost doubled, (8,2% avg increase between 2005-2015)) and future increases are expected.

2. Risk distribution – Historically, wood prices do not follow general developments on stock markets. Therefore, investing in wood is a solid foundation for a diverse portfolio.

3. Inflation resistant – An investment in forestry is immune to inflation because periods of inflation are generally coupled with a strong increase in the price of wood.

4. Added value – Apart from yielding high revenues, investing in forestry offers an opportunity to contribute to the lasting recovery of nature.

The following calculations provide the estimated value of the investment:

Market Price for European Cherry Wood (2016) = 500.00 Euros – for prime quality wood (16” diameter & up, 10’ & longer, no visible defects,clear 4 sides, no rot, shake, split, fresh cut, ) no sap stain

Value of wood from 7200 Mature Cherry Trees (2016) = 7,200 x 500.00Euros = 3.6 Million Euros

Value 2030 at a 12,8%* yearly increase = 15.2 Million Euros

Yearly Return on a 1,98 Million Euro Investment (ROI) = 18.5% ROI (14yrs)

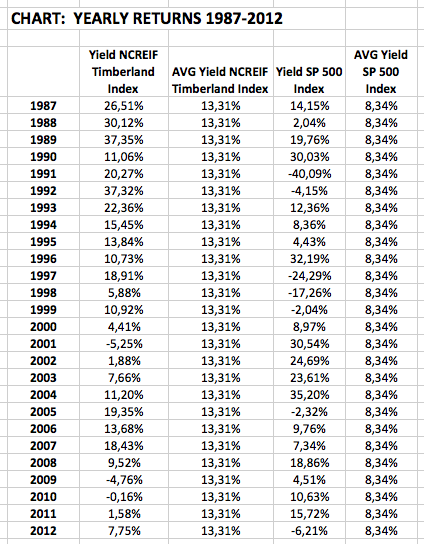

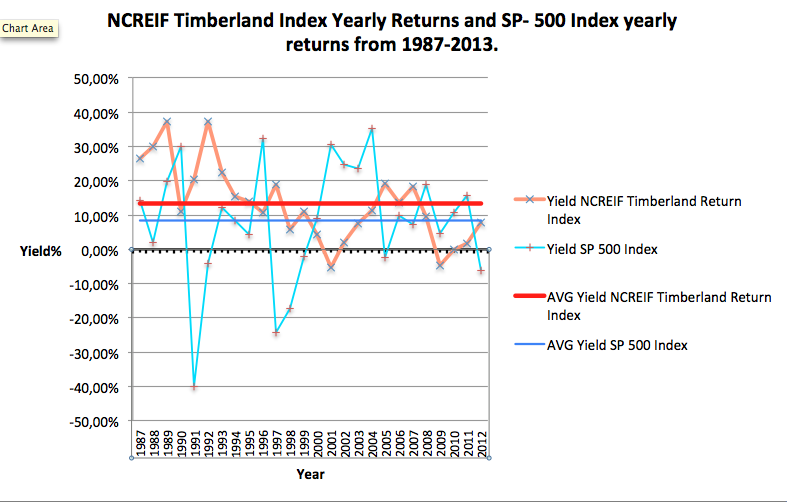

* The 12.8% Yearly return estimate is based on the NCREIF Timberland Index historical average returns available from 1987 to 2015. This index is an independent, industry-wide measure of returns based on the actual performance of managed tree farms since 1987. Click here for an explanation of this Index.

The following chart provides a graphical summary of the NCREIF Timberland Index annual returns since 1987 as well as the returns from the Standard and Poors 500 Index for the same period (1987-2013) for comparison purposes:

* Maintenance costs range from 15,000-20,000 Euros annually for pruning, clearing of scrub, and fertilizing, and are negligible when compared to the total value of the investment, and are therefore not accounted for in the ROI calculations.

Click on the Map to enlarge.

Click on the Map to enlarge. English

English Español

Español Deutsch

Deutsch Nederlands

Nederlands Русский

Русский 繁體中文

繁體中文 日本語

日本語 简体中文

简体中文